The most important part of buying life insurance is determining how much you need. Since everyone’s financial circumstances and goals are different, there is no rule of thumb to tell you how much to buy.

But do you really need $250,000, $500,000, $1 million or more? Sounds like a lot of money, but imagine if one of those amounts had to pay for a funeral, retire credit card balances and other debts, and support your loved ones for many years to come. Would it be enough? How would you know?

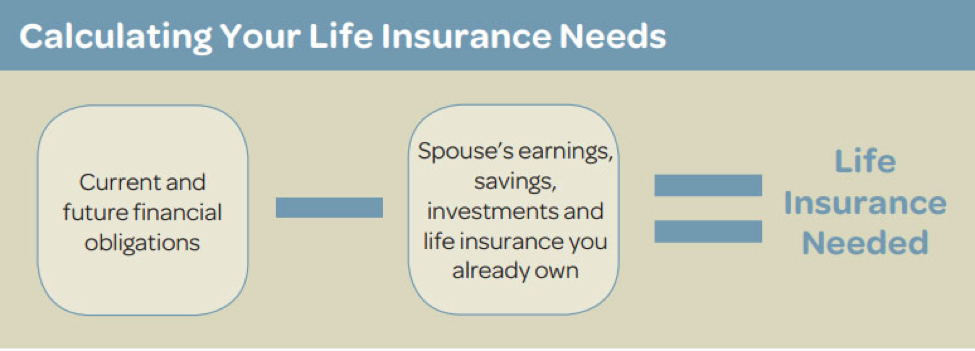

To start, estimate what your family members would need after you’re gone to meet immediate, ongoing, and future financial obligations (see below for examples of each). Then, add up the resources your surviving family members could draw on to support themselves. These would include things like a spouse’s income, accumulated savings, life insurance you may already own, etc. The difference between the two is your need for additional life insurance. This mathematical equation may seem simple enough, but coming up with all the inputs can get tricky. Plus, you’ll need to factor in the effects of inflation and assumptions about how much your investments will earn over the long run.

Insurance Proceeds Can Fund Many Types of Expenses

Immediate Expenses

- Funeral costs

- Uncovered medical expenses

- Mortgage

- Car loans

- Credit card debt

- Taxes

- Estate settlement costs

Ongoing Expenses

- Food

- Housing

- Utilities

- Transportation

- Health care

- Clothing

- Insurance

Future Expenses

- College

- Retirement

About 38% of Americans believe they would feel the financial impact from the death of the primary wage earner within a month of their passing.1 When you consider all the things that life insurance proceeds need to fund and how long the money will be needed, you begin to realize that your true need for coverage is often 10 or 15 times your gross annual income, sometimes more.

Fortunately, there are plenty of resources you can turn to for assistance. The first step is easy: Commit to finding out what kind of coverage is right for you. Just remember there are no substitutes for the advice you’ll get by meeting with a qualified insurance professional, who can conduct a thorough analysis of your needs, and then help you determine the right amount and type of life insurance to protect the ones you love. So be sure to talk to your financial professional today.

The opinions voiced in this material are for general information only and are not intended to provide specific advice or recommendations for any individual. To determine which investments or products may be appropriate for you, consult with your financial professional.

Sources:

1The 2017 Insurance Barometer Study, Life Happens and LIMRA

Adult Financial Education Services (AFES)

July 2017

68 Comments